TaxMama’s® TaxQuips Flaw in the Tax Law - Casualties

2022-07-07 by Eva Rosenberg

It’s TaxQuips time from TaxMama.com® .

Today TaxMama® wants talk to you about a big flaw in the current tax laws.

Dear Family,

It’s summer! Can you believe the year is going by so quickly?

The past month has been a whirlwind with teaching, taking classes and even going to a live, in-person CSTC Tax Symposium in Reno. It’s the first time since early 2000 that I have had the opportunity to meet friends, peers, students and TaxMama® fans. We met, learned, hugged, ate a LOT – and didn’t get the least bit sick. (Well, OK…a little sunburnt…but that passes.)

I also got started on a new crusade – to fix the tax law neglect when it comes to the Romance Scams – and the 14 other scams listed on the FBI’s site.

The problem? The Tax Cuts and Jobs Act (Trump Tax Act) completely eliminated taxpayers’ rights to deduct casualty and theft losses – unless they were in Presidentially-declared disaster areas.

As soon as I saw that in the law, it was clear this was going to be a problem for all the people who face routine disasters – like a fire burning down their home because of a smoldering cigarette; burst plumbing flooding the house (especially folks who are gone from home in the winter); people getting their assets stolen in scams that do not meet the limited definition of a Ponzi scheme; vandalism or theft from local thugs (or tenants)…and the list goes on.

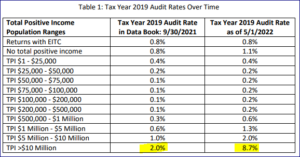

Well, now it hits home. A client got scammed for over $400,000. There may actually be a round-about way to claim the deduction – but it’s almost guaranteed to be audited. So I would much rather find a way to change the law itself.

I am totally open to your help if you have contacts to bring this about.

It will affect the millions of people who have been victimized in the 15 scams on the FBI list – and possibly others, depending on how broadly we can change (or re-interpret) the Tax Code or Regulations. Perhaps you, or your family or friends – or clients have been affected, already. (Romance Scam victims have lost over $1 BILLION dollars in in 2021.)

Here’s what I was thinking – it’s really hard to get Congress to act jointly on practically anything these days. So I wanted to find a work-around.

But here is a possibility – the Seniors Fraud Prevention Act is a bi-partisan bill from Senators Susan Collins® and Amy Klobuchar (D) that recently passed by both houses! However, it’s limited to education and monitoring – and doesn’t go far enough to get those seniors the casualty loss deduction. If you have a way to reach either of these legislators, please help me ask them to add this to their bill – or add it to an upcoming bill.

Knowing this can take years, I have started the process to reach out to the IRS and the Taxpayers Advocate Service (TAS) to start exploring solutions – and to see if anyone can take this issue to the Secretary of Treasury, or someone close to President Biden or Vice President, Kamala Harris. Why, an easy solution would be to have the President declare these scams as Presidentially-Declared casualties. Then we don’t have to change the law itself. (There is precedent for a non-geographic declaration – COVID19.)

If I can get something started and know that there is movement, either with respect to legislation, or a potential Presidential declaration, then everyone who has been affected could file a “Protective Claim” to request a refund once the law or procedure change has been confirmed. What does that mean? It means that you won’t lose the right to deduct the losses and get a tax refund three years after the tax return was filed. When a “Protective Claim” is filed within those three years, it makes it possible to get that refund, even if it takes 10 years or more for the legislation to change. But to file that “Protective Claim,” we need to be able to point to some tangible activity that will ultimately make these deductions kosher.

This is probably a crazy idea. But the people I have spoken to at the IRS, TAS and even Kelly Phillips Erb at Bloomberg, think there may be something to this.

So if you can help – please do. If you, or someone you know, has been affected, I would love to hear from you. Especially if they are willing to be profiled in the press. Use this email address so we can track your responses – romancescamtax@gmail.com

That’s it for now.

And remember, you can find answers to all kinds of questions about taxes and business issues, and EA Education, free. Where? Where else? At http://iTaxMama.com/AskQuestion

To make comments please drop into the TaxQuips Forum.

Download the Media (0:00min, 0MB) or listen now...

- Ask TaxMama

- Where Taxes are Fun

- TaxQuips

- The best Free Tax Podcast Online

- TaxQuips Forum

- Where you can you ask your tax questions

- TaxMama.com

- Where you can you can read the full post